Introduction

The Desert Housing Report for June 2024 provides an in-depth analysis of the housing market trends in the Coachella Valley. This comprehensive report, produced for Valley agents with the cooperation of GPSR and CDAR, highlights key metrics such as median home prices, sales trends, inventory levels, and more. This analysis will give potential buyers, sellers, and real estate professionals a clear picture of the current market conditions.

Market Highlights

- Sales Trends:

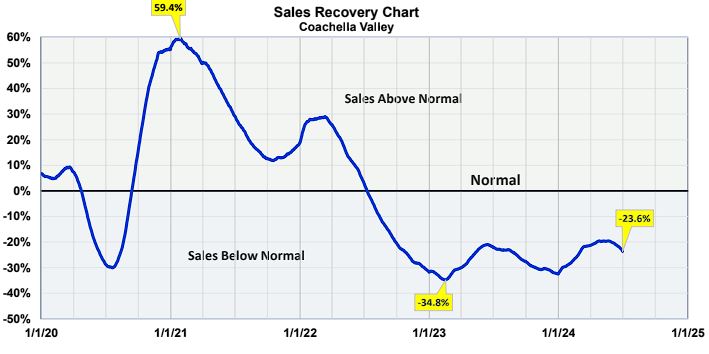

- Sales Recovery: The seasonally adjusted sales recovery chart indicates that sales are currently 23.6% below normal. This is a decline from the previous three months, signaling a slowing recovery. During the pandemic in June 2021, sales were 59.5% above normal, but by June 2023, they had fallen to 34.7% below normal.

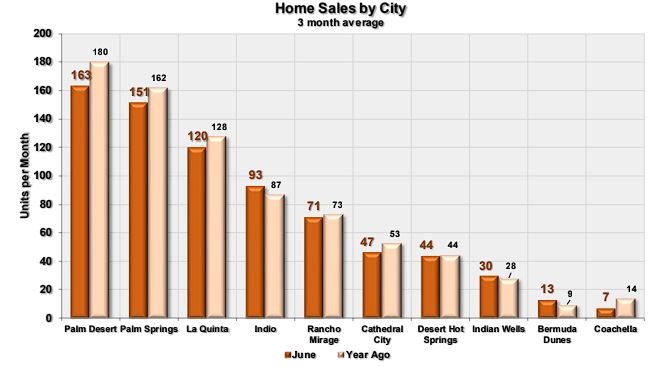

- Monthly Sales: The three-month average sales figure for June was 739 units, compared to 798 units the previous year. Palm Desert leads in unit sales with 163, followed by Palm Springs with 151.

- Price Trends:

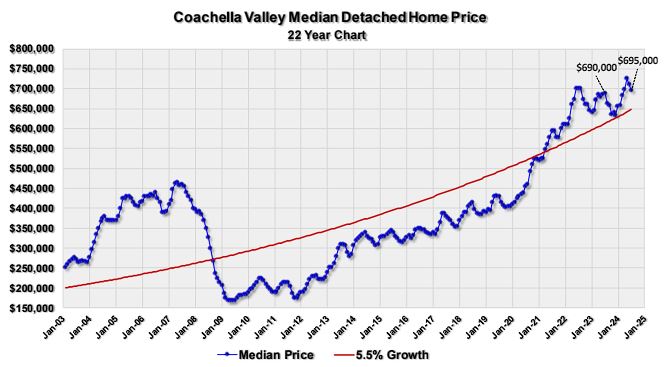

- Detached Homes: The median price for detached homes decreased to $695,000 in June after reaching an all-time high two months prior. This represents a year-over-year increase of only 0.7%.

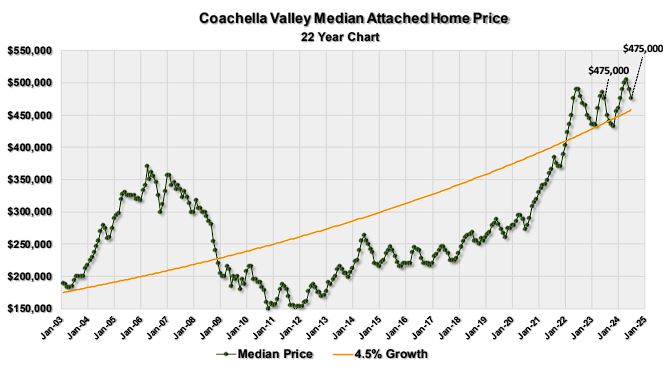

- Attached Homes: The median price for attached homes remained steady at $475,000, unchanged from the previous year.

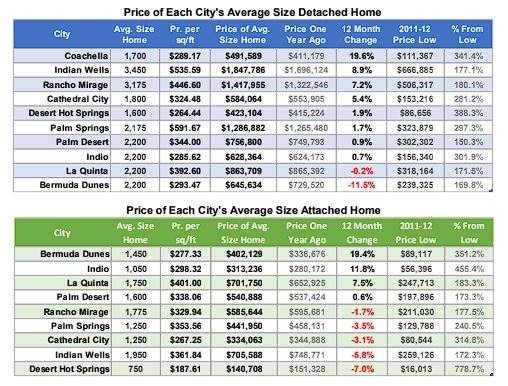

- City-Specific Trends: Year-over-year price changes vary across cities, with Coachella seeing a 19.6% increase in detached home prices, while Bermuda Dunes experienced an 11.5% decline. For attached homes, Bermuda Dunes saw a 19.4% increase, whereas Desert Hot Springs faced a 7.0% decrease.

- Inventory and Sales Ratios:

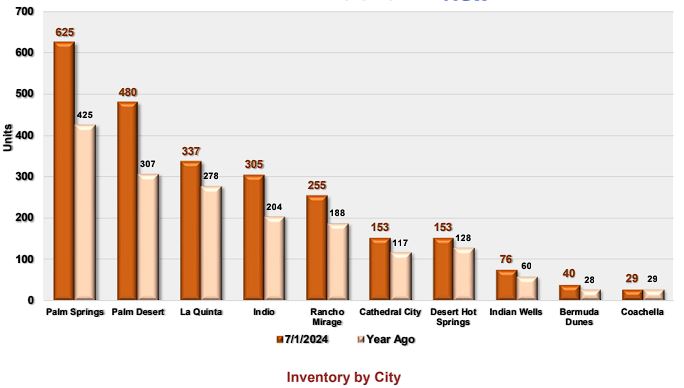

- Inventory Levels: As of July 1st, the inventory in the Valley stood at 2,464 units, 146 units less than the previous month. The inventory is expected to decline further during the summer months.

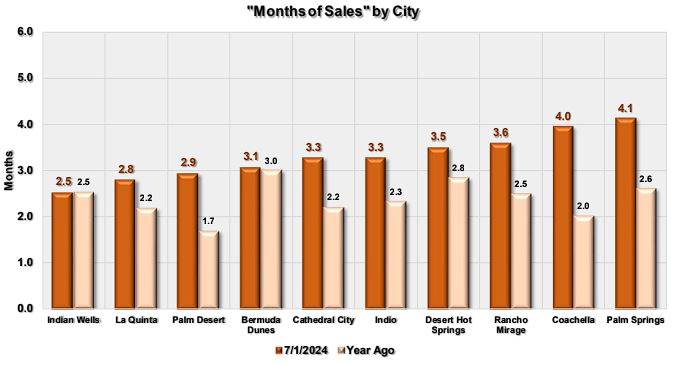

- Months of Sales Ratio: The current months of sales ratio is 4.0 months, indicating a balanced market. This ratio is 1.1 months higher than the previous year.

- Days on Market (DIM):

- The median number of days on market for homes in the Coachella Valley at the end of June was 45 days. This is seven days more than last year, with Coachella having the lowest average selling time of 18 days and La Quinta the highest at 53 days.

- The median number of days on market for homes in the Coachella Valley at the end of June was 45 days. This is seven days more than last year, with Coachella having the lowest average selling time of 18 days and La Quinta the highest at 53 days.

- Price Discounts and Premiums:

- Detached homes sold at an average discount of 2.0%, while attached homes sold at a 2.6% discount. Coachella is the only city where homes sold at an average premium of 0.1%, whereas Bermuda Dunes had the largest average discount of 4.2%.

Detailed City Analysis

- Coachella: The average size home (1,700 sq ft) is priced at $491,589, reflecting a 19.6% increase from the previous year. Homes here are selling quickly, with an average of 18 days on the market.

- Palm Desert: With the highest unit sales per month (163), the average home (2,200 sq ft) is priced at $756,800. The price change from the previous year is modest at 0.9%.

- Palm Springs: The average home price is $1,286,882, with a slight year-over-year increase of 1.7%. The median days on market are higher at 43 days.

Sales by Price Range

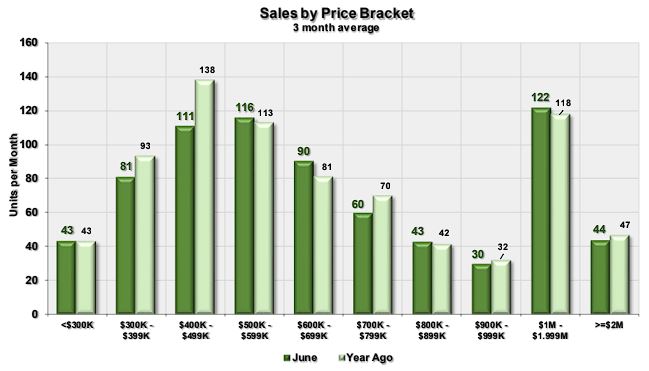

Sales across different price ranges have shown mixed trends. While sales for homes priced below $500,000 have decreased, those in higher price brackets have remained relatively stable. This indicates a well-balanced market across most price ranges.

Conclusion

The Coachella Valley housing market is experiencing a period of adjustment, with sales below historic norms and a slight decline in median prices for detached homes. Inventory levels are decreasing, and the market remains balanced with stable months of sales ratios. Real estate professionals and potential buyers should closely monitor these trends, especially considering potential changes in interest rates by the Federal Reserve which could stimulate further market activity.